How to spot emerging technology innovation at public companies

How can you spot emerging technology innovation at public companies? And how could you scale this up, so that you could track not just a handful but hundreds or even thousands of companies? For this article, I analyzed more than 650,000 financial news to find out.

Emerging technology innovation at public companies

How can you spot emerging technology innovation at public companies? And how could you scale this up, so that you could track not just a handful but hundreds or even thousands of companies?

But first, let me clarify what I mean by “emerging technologies, “innovation, and “public companies”.

By “emerging technologies” I mean technologies that are gaining in momentum — not necessarily brand-new technologies. For example, digital twins or machine vision are not new, but they have been gaining momentum over the past few years.

When I say “innovation”, I mean something that’s more than just a paper, a patent, or a concept. There also has to be some tangible intent of business building. For example, a new product or project, a joint venture, or a new pilot plant.

By “public companies” I mean companies that are listed on at least one stock exchange.

And just to be clear, my goal here was not to do a full-blown, comprehensive analysis. Rather I wanted to test out a few methods that could be scaled up in the future.

My methods: The companies portfolio, data, and analysis

(If you’re not that interested in my methods, feel free to skip ahead to the results)

The companies portfolio

I made a portfolio of 126 companies from various industries. Some of the companies are household names such as BASF, Honeywell, or NVIDIA. Other companies are probably less well-known. In addition to companies I come across in my work, they include holdings of ARK Invest ETFs, and some of the companies Nanalyze writes about.

I assigned each company to one industry sector, even though this isn’t always straightforward (more on this below).

Take a look at my my portfolio here ->

The data

I analyzed financial news, which is one of Mergeflow’s data sets. The reason for using financial news is I was interested in technologies that already have some business footprint, as I mentioned above. And even with this limit, and a small portfolio of only 126 companies, my data set included more than 654,500 documents.

I did not consider patents and R&D publications because these are often not directly related to business building. In other words, there might be a patent or a paper but never any business that comes out of it.

The analysis

I wrote analysis code against Mergeflow’s API. This allowed me to do bulk analyses, rather than just manual one-off searches. For my analyses, I did the following:

- Get all financial news that mention any of my portfolio companies. I used financial news from the last 5 years. This way I got a data set of 654,500 documents.

- In my data set, have Mergeflow identify any of more than 200 emerging technologies that are mentioned in the context of any of my portfolio companies.

- Make 5-year, 1-month-resolution, time series for each “company x emerging technology” combination. In total, these were 126 companies x 228 emerging technologies = 28,728 time series.

- Rank these “company x emerging tech” time series by “rising activity”: Those time series that had the highest “most recent 3 months” activity, compared to the overall time series, were ranked highest.

- Using the ranking and some cutoffs (e.g. “number of news in last 3 months greater than 0”), I got a set of 18 highest-ranking “company x emerging tech” time series.

- For the 18 highest-ranking “company x emerging tech” combinations, do some more content analyses to discover types of emerging tech innovation (more on this later).

Which companies show an increase in emerging technology innovation?

As mentioned above, I made 28,728 time series, one for each combination of portfolio company and emerging technology.

I sorted the time series by “activity increase”. I defined “activity increase” as:

activity increase = average recent activity / average overall activityThen I applied various cutoffs, such as “time series must have more than 0 news during the most recent 3 months”, or “more than 5 news during last 5 years”.

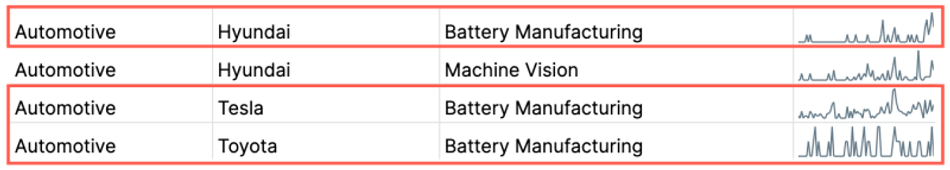

After sorting and applying the cutoffs, I got the following 18 “winning combinations” from Mergeflow's API:

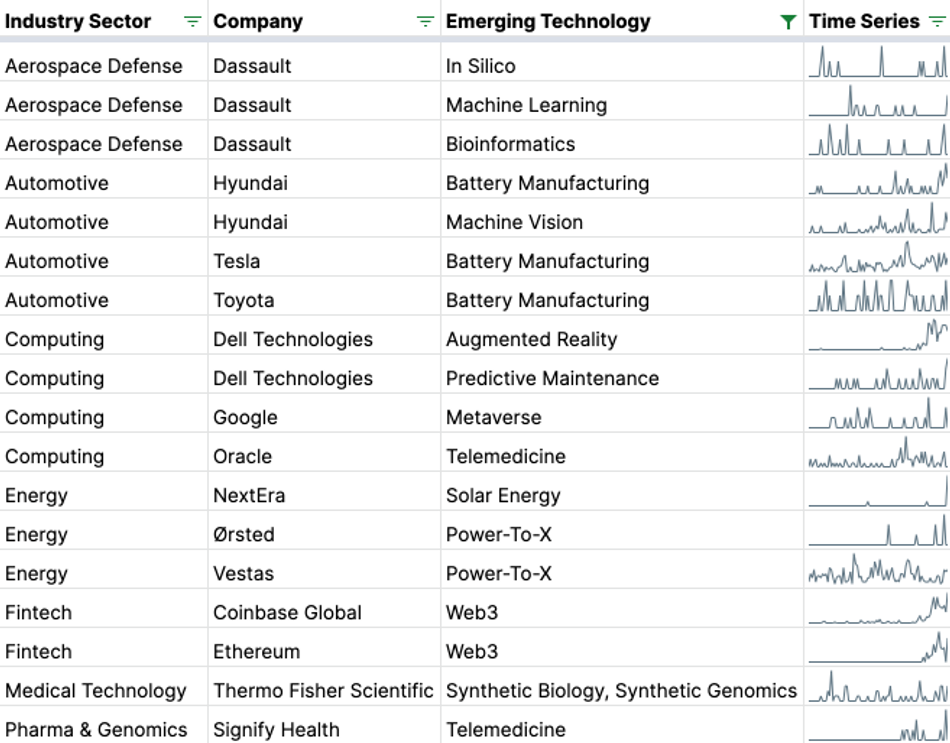

Out of a total of 28,728 “company x emerging technology” time series, these are the 18 that showed the strongest recent (last 3 months) rise in news volume. Data from Mergeflow’s API.

Out of a total of 28,728 “company x emerging technology” time series, these are the 18 that showed the strongest recent (last 3 months) rise in news volume. Data from Mergeflow’s API.When you look at this table, there are some combinations that are hardly surprising. For example, it’s quite obvious that “Web3” is rising at Coinbase and Ethereum, given what these companies do.

But there are combinations that I found more surprising. For example, “Dassault” and “in silico” and “bioinformatics”.

In order to understand better what’s behind these surprising combinations, I zoomed in on some of the combinations. I wanted to see if there are patterns or types of emerging tech innovation.

3 types of emerging technology innovation

Knowing more about types of emerging tech innovation would help make the approach here more scalable. For example, we could run analyses for much larger company portfolios, and try to detect innovation types.

But knowing more about innovation types might be interesting from a valuation perspective as well. Some types might be more valuable because they are likely to be more durable, for instance. Or there might be differences in risk; different types might be associated with different kinds of risk. I will come back to this below, after describing 3 emerging tech innovation types.

Why 3 types? It’s simple — I didn’t have the time to research more types. For the same reason, not enough time and not enough space here, I’ll only describe a few examples of each innovation type.

Type 1: Innovating from one industry sector into another

This is when a company enters another industry sector or market. For example, this could be a gaming company that starts developing simulation technology for construction applications. Or, and this takes us to the first example below, an aerospace company that starts building life science technology.

Dassault: From aerospace to life sciences

Dassault (FRA:DSY), typically seen as an aerospace company, also innovates in life sciences. We saw this above, in the table that shows emerging tech innovation over time. For Dassault, In-Silico and Bioinformatics showed rising activity over the past 5 years.

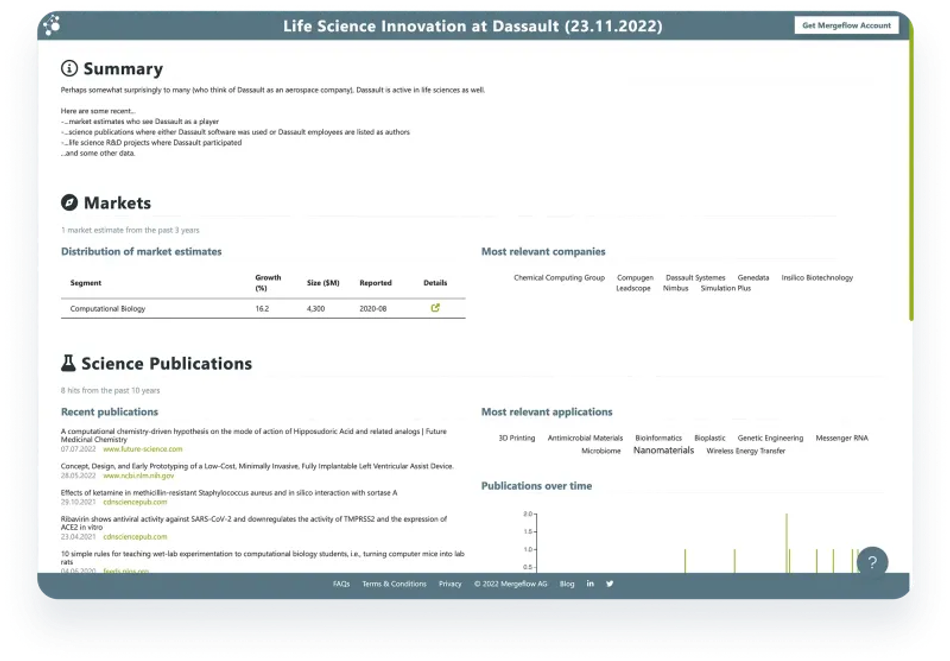

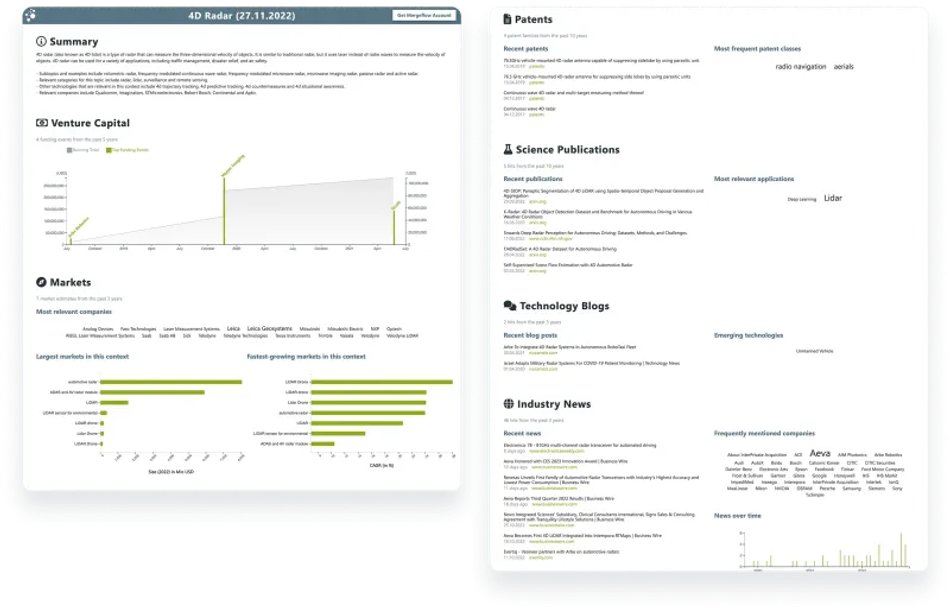

Below is a report generated with Mergeflow that shows life science innovation at Dassault more broadly:

Life science innovation at Dassault. Snapshot of some recent activities across markets, R&D, and business. Report generated with Mergeflow.

Life science innovation at Dassault. Snapshot of some recent activities across markets, R&D, and business. Report generated with Mergeflow.Oracle: From databases and cloud-engineering to telemedicine

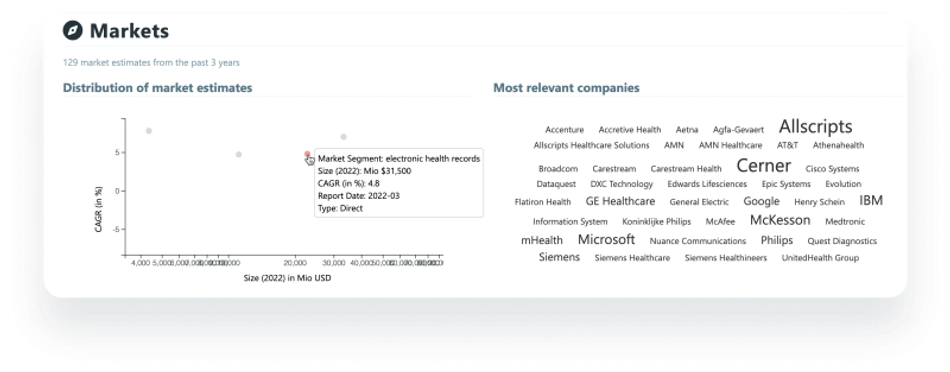

Via its recent acquisition of Cerner, Oracle (NYSE:ORCL) moved into the healthcare tech sector. Cerner is an electronic health records (EHR) company. According to Mergeflow’s market analysis data, Cerner is one of the most-noticed players in the market (the larger the font size in the tag cloud, the more analyst reports feature a company in a given market, in this case the EHR market):

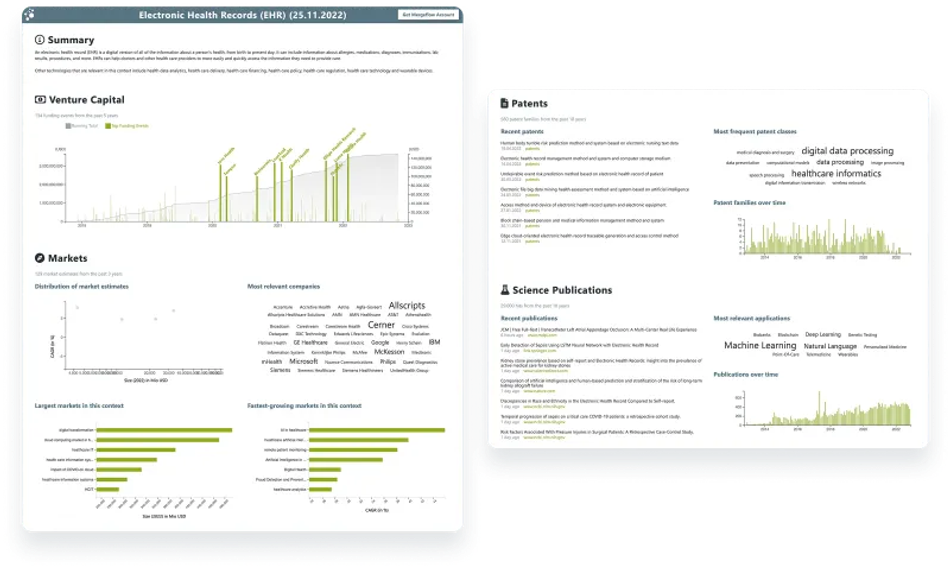

To provide some context, EHR is a busy field. There is substantial R&D, venturing and market activity. You can see this in the report from Mergeflow below (click on the image to see the interactive report):

Mergeflow report on electronic health records technology.

Mergeflow report on electronic health records technology.Type 2: Innovation partnerships and networks

By “innovation partnerships and networks”, I mean projects that involve several companies, or joint ventures (which might, unlike projects, involve some kind of equity agreement).

Ørsted and Energy Dome work to combine renewable energy generation and long-duration energy storage

Ørsted (CPH:ORSTED) is a big renewable energy provider, with a focus on offshore wind power. Energy Dome (www.energydome.com) is a privately held company that makes CO2 batteries.

These CO2 batteries are a form of power-to-x technology, and they are made for long-duration energy storage. I wrote about Energy Dome in a previous article, about thermal energy storage technologies.

In September 2022, Ørsted and Energy Dome (www.energydome.com) announced a partnership to build long-term energy storage for renewable energy projects.

The project aims to address an important issue: wind and solar are transient energy sources. In other words, the wind doesn’t always blow, and the sun doesn’t always shine. And the combination of both, no wind and no sun, has been called Dunkelflaute. And because we don’t want this or run into problems with power grid stability, we need to combine wind and solar energy with long-term energy storage.

Dell Technologies: A founding member of 5G Open Innovation Lab

Dell Technologies (NYSE:DELL) is a founding member of 5G Innovation Lab. 5G Innovation Lab is a network that brings together enterprises and startups working on 5G technologies. As the name suggests, they also have a lab where 5G innovations can be built and tested under real-world conditions. One focus area of the lab is agriculture: The goal here is to innovate in IoT, sensor, supply chain, and other topics where 5G is relevant to agriculture use cases.

Hyundai enters a joint venture with Aptiv to develop autonomous vehicles

Hyundai (KRX:005380) and Aptiv (FRA:D7A), an automotive supplier, formed a joint venture to build autonomous vehicles (autonomous vehicles involve machine vision, hence the rising timeline “Hyundai and machine vision” above).

At CES 2022, Aptiv presented the Hyundai Ioniq 5 Robotaxi:

For the Robotaxi, Aptiv uses 4D radar, or 4D LiDAR. 4D radar can measure the three-dimensional velocity of objects. Here is a report from Mergeflow on 4D radar:

Type 3: Innovation spurred by tax breaks

Part of the US Inflation Reduction Act of 2022 are substantial tax breaks for electric vehicle and battery manufacturing. And these tax breaks have an effect, which showed up in the “company x emerging tech” time series analysis I described above:

Zooming in on the news behind these time series shows that a number of automotive companies are now investing in battery production in the US. And some of Tesla’s battery production capabilities could be moved to the US from Germany, where they were originally intended to be built.

Could certain emerging technology innovation patterns be “worth more” than others?

I mentioned above that innovation types might be interesting from a valuation perspective as well. In other words, certain types of innovation might contribute more to the value of a company, or some might carry more risk than others.

I’d like to emphasize that at this point, these are just hypotheses. But here is how I’d assign values and risks to each of the three types of emerging technology innovation I described above:

Type 1 (innovating in a new industry sector)

Perhaps the highest-value, but also the highest-risk, type of the three. Highest-value because you own it, and you diversify or move into a higher-growth sector. Highest-risk because the required investment is probably highest for this type of innovation. Plus, it probably takes the longest time.

Type 2 (partnerships and networks)

Perhaps even higher-value still, if what you build is a platform business model, and the platform is yours. If it’s a loosely coupled network, the value is probably lower, but so is the risk.

Type 3 (innovation encouraged by tax breaks or other government incentives)

The most transient type of innovation, in my estimate. Politicians and governments come and go, and tax breaks with them. But it might be a good vehicle for getting into Type 1 innovation, innovating in a new industry sector, because it might alleviate a substantial portion of the investments required to get started.