Collapsing Design Cycles and Intelligent Decision Making in the Electronics Value Chain

Insights derived from engagement with technical digital content are assisting designers and component makers at every stage of the electronic design process.

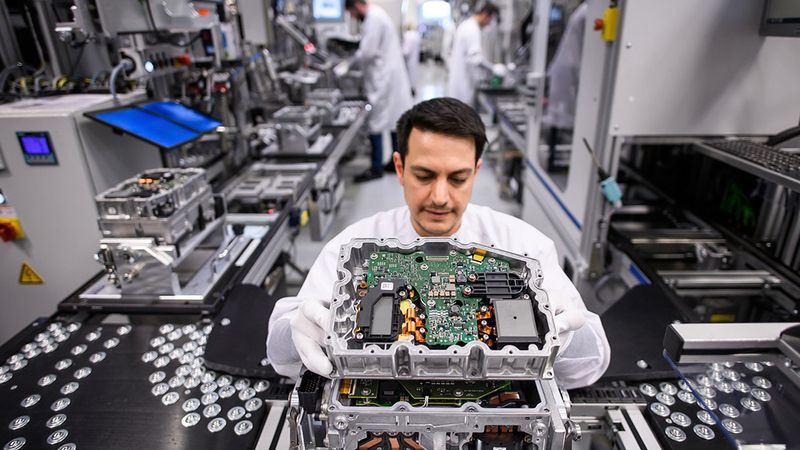

Continental

In our previous articles on the Printed Circuit Board (PCB) design and manufacturing cycle we focussed heavily on the role of online CAD libraries. In this new article, we look at the broader electrical design cycle and examine the services that are assisting engineers to make intelligent data-driven design decisions.

The electronics design cycle

The development of any new electrical device or system requires an enormous amount of stakeholders, talents, technologies, and markets. As manufactured products across industries are increasingly electrified, this design cycle must evolve, and embrace the technologies that accelerate innovation and speed to market. Two of the most influential players in this system are the development engineers, who are designing devices and integrated systems, and the manufacturers who are providing the components for use within those systems. Each relies on the other to continue innovation, however, the gap between these two groups has been significant, resulting in an inability for either party to peer inside the design ecosystem and understand the impact of the others design considerations.

Designing with Intelligence

The electronics design cycle involves massive amounts of data associated with parts, components, and interoperability requirements each step in the process requiring deliberate and consequential decision making. Harnessing this data, and analyzing usage trends, design intent and demand creates a massive potential for better decision making, reduced costs, faster time to market, and better collaboration.

Recognizing the value of this data and engaging in ways to collect, distill and apply it will radically improve the overall design cycle, reduce time to market, improve the resilience of product, ensure a more competitive market and create space for innovation.

Where is the data and how can it be captured, synthesized, and applied?

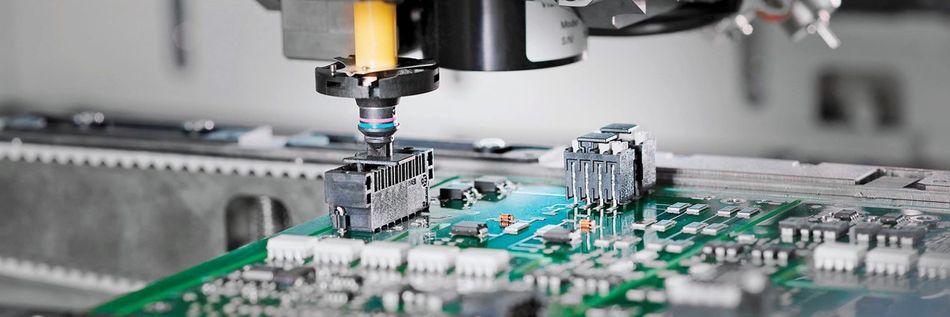

This data comes from several sources. A good starting point for understanding the amount and value of the data is the way part and component assets are provided to engineers. All engineers must go through a process of researching and selecting components for use within their design, the individual properties, size, and quality of the components have a massive impact on the end product. As described in previous articles, the biggest change in CAD-based PCB design is the advent of free online CAD component libraries. These libraries allow engineers to download clean CAD models directly to their workspaces. While this supports the engineer’s efficient workflow it also creates a very valuable insight into which components are being downloaded where, essentially giving suppliers a view into the future by seeing which components will be in demand. Further analysis and integration of design tools would provide insights into exactly what products these components are being used in.

Looking the other way, designers using these libraries can see quickly the cost, inventory, and iteration of the components they choose, allowing them to make decisions that will future proof designs against lack of supply, etc. These data-gathering points can be further broken down into categories and examined for value opportunity for both designers and suppliers to the system to find the opportunity to insert intelligence into decision making across the design cycle.

Search Intelligence

As discussed above, search intelligence provides designers not only with fast high-quality CAD models for direct integration into design software, but also a way to understand the demand and inventory on these items anticipating future demand and supply which provides visibility into futureproofing, allowing the designer to decide based on this knowledge if they are making the most resilient choice. We dived deeper into the benefits of intelligent component search for designers in our interview with PCB designer Johnnie Howman and the benefits for the supplier side in a discussion with semiconductor manufacturer, Nexperia.

Price analytics

Insight into the price of components across manufacturers with the context of the market gives the opportunity to make informed decisions for overall product competitiveness and resilience. This data not only informs overall product cost but insights into the risk and availability of components that can affect time to market, assembly timelines, and iteration planning. From a supplier perspective, understanding the consequences of the pricing and availability data gives guidance to marketing and manufacturing design decisions.

Overview design history

Knowing the design decisions of engineers in similar workflows to your own provides the ability to design with full authority. This use of data intelligence collapses organizational structures and increases visibility and collaboration across the industry. It can be thought of as like checking for 5-star reviews on Amazon - reassuring yourself as a potential consumer of a product that it meets the quality, performance, and availability requirements of your peers, as well as vouching for the service from the product manufacturer.

For designers, if they can see that a particular component has proved highly popular with other designers (as indicated by stock availability in the market for example, perhaps due to competitive pricing from the manufacturer) then this helps add confidence to their decision to design with it. This increased confidence has other knock-on effects such as shorter design cycles more space for innovation.

Behavior modeling

Behavior modeling allows component manufacturers to get an early view of what parts designers are using, in order to influence their plans for the parts proving "popular". This essentially gives suppliers an ‘over the shoulder’ view of the design process that they can use to inform decisions on asset delivery and marketing as well as engage and influence decision-makers at the design end.

Data backed pricing analysis

Traditional ‘request for quote’ processes is a potential bottleneck in an efficient road to market. Aggregating pricing data across the entire supply chain can provide an opportunity for engaging in the quoting process in a whole different way that provides benefits to all stakeholders. Suppliers can combine market intelligence with customer account purchase patterns to optimize quotes for margin. While designers can optimize designs for target costs, and mitigate the risk of downstream supply disruption.

Supply Intelligence

Supply intelligence reveals stock and inventory data, as well as critical timelines that may influence design decisions. It’s hugely beneficial for all parties and is a key data point that has previously been extremely difficult to access. Take the following example; some highly popular components or at times, component categories (e.g. Tantalum capacitors) can go into long-term supply issues due to the high demand. They end up being designed-in to huge numbers of products (for all the right reasons) and hence demand soars. Usually, manufacturers forecast and position themselves to meet the demand but in some cases a critical part of supply chain breaks (perhaps cobalt supplies for Lithium-ion batteries) creating shortages and long lead-times. Many designers are oblivious to this until it's too late as they are typically separated from the purchasing/supply process. So by having true supply intelligence available at the time of designing, they can be aware of any product issues or shortages, then make appropriately informed decisions.

Data into intelligence

It's easy to see just how much data exists in the electronics value chain and the benefits that using that data can provide. However, it's also clear that much of this data is either locked away in inaccessible channels or if possible to access is so complex, the analysis and presentation is far too resource-heavy an investment. The answer to this is two-pronged, the first is a recognition by all players across the chain that a data-driven approach is essential for the next leap in innovations, and secondly dedicated players in the space to act as the gathers and filters for the ‘data.’

Supplyframe

SaaS company, Supplyframe, has built a software product that enables this existing data to be converted into insights that support decision making and offers resilience. Supplyframe’s goal is to allow engineers and suppliers to inject data-driven intelligence into their processes resulting in innovation across the space. They do this by providing a suite of applications useful for all players in the space to access relevant data and the context to apply it. For suppliers and distributors, this means delivering actionable insights that drive better decisions across new product development initiatives, full product life cycles, and strategic sourcing of direct materials. For designers and manufacturers, this is access deep into the decision-making process, transparency across component supply, and insights into design trends and strategies.

Conclusion

The electrical design cycle is a data-rich space that requires a layer of analysis in order to create a connected, intelligent design-to-source lifecycle. The road to the ubiquitous use of data-driven intelligent decisions making for all stakeholders in the electronics design cycle is prepared and will be unlocked by engagement with the right applications across the industry.

About the sponsor: Supplyframe

This article is sponsored by Supplyframe. Supplyframe aligns electronics demand with supply and brings new levels of resiliency to the global electronics value chain, with transformative, intelligence-based solutions to deliver insights at key decision points throughout the entire design-to-source product lifecycle. Leveraging billions of continuous signals of design intent, demand, supply, and risk factors, Supplyframe’s Design-to-Source Intelligence (DSI) Platform is the world’s richest intelligence resource for the electronics industry. Over 10 million engineering and supply chain professionals worldwide engage with our SaaS solutions, search engines, and media properties to power rapid innovation and optimize in excess of $120 billion in annual direct materials spend. Supplyframe is headquartered in Pasadena, Calif., with offices in Austin, Belgrade, Grenoble, Oxford, San Francisco, Shanghai, and Shenzhen.