Aerospace manufacturing in 2023

In early 2023, a joint survey from the Royal Aeronautical Society and Protolabs was conducted to learn more about the aerospace sector’s most important concerns and top priorities. Tim Robinson FRAeS examines the results, and provides you with a breakdown.

It may be a cliché, but it is a time of unprecedented change in the global aviation, aerospace and space industry. No sooner had the Covid pandemic ended, temporarily grounding air travel, than a high-intensity peer-on-peer war erupted in Eastern Europe with Russia’s invasion of Ukraine. Climate action, meanwhile, is now top of the agenda in many places, and the aerospace industry is racing to decarbonise itself – even as it

struggles with supply chain shortages and a skills crisis. Meanwhile, sci-fi dreams of flying taxis, rockets that land vertically, hotels in space and now AI that can hold lengthy conversations with humans are almost here. All of these external factors make for a challenging landscape for today’s firms to navigate when deciding on technology and investment priorities.

This landmark survey, with an impressive take-up, saw over 1,800 responses from RAeS members, with respondents ticking job roles, such as Engineer (29.48%), Procurement (15.15%), Product Designer/

Development (13.66%), R&D (12.61%), Retired (8.46%), Other (8.08%), IT/Digital (7.47%) and Student (5.09%).

In addition, as might be expected for the ‘Other’ category, this also included a significant number of respondents with ‘pilot’ in their job title. In terms of seniority, some 27.32% of respondents were in the ‘Middle Management’ category, while 23.41% described themselves as ‘Experienced’ and 21.73% as ‘Team Lead’ level. Let us take a look at some of the key takeaways from this survey.

Key takeaways

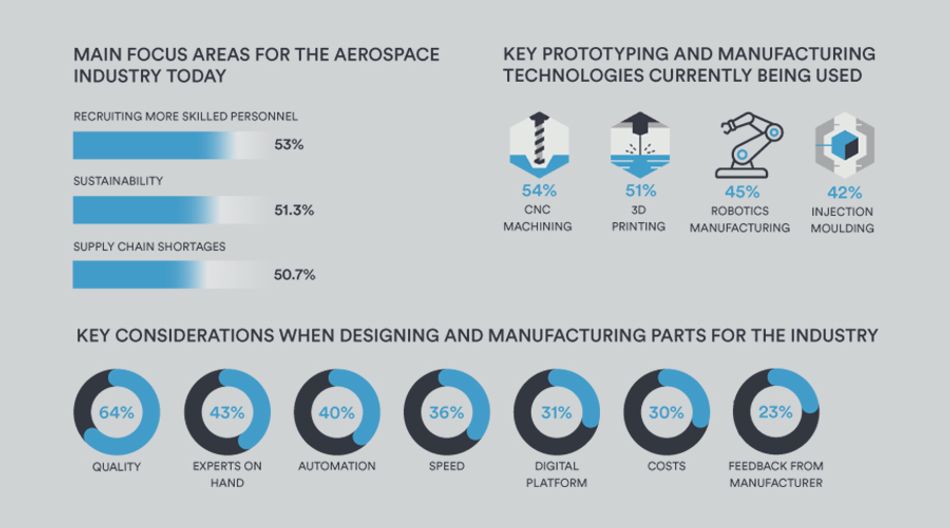

Reflecting on the key priorities of the global aerospace industry, recruiting more skilled personnel was chosen as the number one focus by respondents at 52.9%, closely followed by Sustainability (51.6%) and Supply Chain Shortages (50.7%). This tracks closely with the sector-wide skills’ crisis the aerospace industry now finds itself in, with a combination of demographics and workers not returning after being furloughed or downsized during the pandemic. Meanwhile, the sustainability agenda is also accelerating as the industry races to decarbonise itself. Yet, aerospace is still reeling and attempting to play catch-up with disrupted supply chains that have played havoc with tightly integrated ‘just-in-time’ global networks. In November 2022, Airbus CEO Guillaume Faury said he expected ‘supply chain constraints’ to last another year.

The ‘Other’ (5.59%) category, which allowed respondents to specify additional issues threw up some further challenges and issues, such as ‘inflation and its negative effects on sustainability and growth’, ‘regulation changes post-leaving EASA’, ‘fuel price increases’ and a call from one respondent to embrace digitalisation fully: ‘the industry is operating in the past. Most of the leaders in the industry are missing the key lessons regarding AI and automated systems. Nobody is looking at information technology as a key component in aerospace...why?'

Meanwhile, the survey found that CNC machining (53.85%) was the key prototyping/manufacturing technology in the aerospace sector, followed by 3D printing (51.41%) and then Robotic Manufacturing (44.88%) and Injection Moulding (41.51%). While the option of CNC machining in grinding, cutting and milling metallic structures as the number one choice is perhaps no surprise for aircraft production, the selection of 3D printing/additive manufacturing by nearly 50% of respondents is more noteworthy. This indicates that 3D printing has now gone mainstream in the aerospace and space industry, passing from a niche ‘rapid prototyping tool’ to more widespread use. Indeed, earlier this year saw the first-ever fully 3D-printed rocket, Terran 1, attempt to reach orbit.

In the ‘Other’ category at 4.10%, additional suggestions included ‘casting’, ‘digital twinning’ and ‘MBSE (model based system engineering)’, as well as several entries suggesting ‘composites and composites moulding’.

In-house or outsourced?

Roughly 25-50% of components are manufactured in-house, found the survey, with 39.68% of respondents picking this option, followed by 23.35% indicating a greater vertically integrated in-house capability at 51-75% and 21.35% for more outsourced enterprises – under 25%. This backs up consolidation trends in the aerospace industry that have seen mergers and acquisitions in recent years concentrate manufacturing in a smaller number of large ‘Tier 1’ or ‘Super Tier 1’ suppliers.

The digital skills gap

However, in embracing the possibilities of this new digital manufacturing landscape, the survey highlighted that the aerospace sector could well be falling behind with respondents selecting ‘Lack of expertise’ as the biggest obstacle – highlighting a growing need for ‘digital natives’ and IT specialists in the aerospace industry. Despite its history of being on the cutting-edge of technology, the aerospace industry is now competing with the financial sector, app developers, AI specialists, motorsports and more. Indeed, consultants McKinsey found that, for every traditional engineer the global aerospace and defence (A&D) industry is trying to recruit, it is also trying to recruit two software engineers. Other challenges identified were ‘Project costs’ – an admission perhaps that investing in ‘Factory 4.0’ technology may be initially expensive. Meanwhile, ‘Secure networks/cybersecurity’ was also highlighted as a concern. This is particularly relevant with the current geostrategic environment and the ‘decoupling’ of some industries with China and Russia.

The industry as a whole is significantly automated with 29.84% of respondents replying their manufacturing was 51-75% automated, followed closely by the 25-50% segment (28.47%). Interestingly, some 11.29% of respondents chose ‘none’ as an answer. This could very well indicate sub-sectors in small batch production, artisan-style manufacturing, such as rebuilding WW2 ‘warbirds’ or assembling custom UAV prototypes.

In automated manufacturing, it would also be interesting to revisit this question in a few years time to see the effect of the nascent eVTOL sector on the answers. Here ‘air taxi’ manufacturers are aiming for automotive-levels of production with Archer and Vertical both planning 2,000 air vehicles a year. This is over double the 661 airliners that Airbus delivered in 2022 and strongly suggests that the level of automation will increase.

As might be expected from a highly-regulated industry designing safety-critical equipment and components, ‘quality’ was the overriding (64%) factor chosen by respondents in designing and manufacturing parts for the aerospace sector. Yet ‘quality’ is not purely just about safety – but also flows into overall costs with tightly integrated and complex supply chains, where the discovery of substandard parts or components can cascade further down the production process and disrupt deliveries. Recent examples include the pause in some Boeing 737 MAX deliveries, due to substandard fittings from Spirit AeroSystems.

The focus on quality, standards and experts on hand was echoed in the largest (47.47%) ‘very important’ answer to the question: ‘How important is certification when working with manufacturing partners?’’

Certification priorities

A free-form poll of the most valuable aerospace certifications to hold produced a wide range of answers – not all of them manufacturing related. However, despite the UK respondents slightly outnumbering US ones in this survey, the number of people who put ‘FAA’ as a single answer outnumbered ‘EASA’ two to one – potentially a sign of how dominant the US still is in the global aviation regulatory framework and the importance of designing products for this key market.

Finally, the top priority for the next three years was again recruiting skills and talent (55.77%), followed by sustainability (52.33%) and ramping up civil production post-Covid (47.56%).

This then is a clear message about the immediate skills and recruitment crisis that the industry is facing – and one that if not solved, then the other two (sustainability/ramping up production) cannot happen. Among the comments in the ‘Other’ category (4.83%) were ‘Competition with China, Security of Proprietary Data And Technology’, ‘Space Exploration and Commercialisation’ and, interestingly, one suggestion that: ‘a strong PR campaign should be launched to counteract present trends that (falsely) consider aviation a highly polluting industry.’

Summary

In conclusion then, this was a landmark survey into the state of the aerospace industry in 2023, providing a significant snapshot of the global aerospace sector as it emerges from the pandemic and attempts to ramp up production, recruit skilled workers and meet sustainability targets. it will be interesting to see what lies ahead for the industry in the future, and good to keep a close eye on how widely digital manufacturing expand through the industry.